Bonds: There When You Need Them by Hartford Funds

With uncertainty on the horizon, talk to your financial professional about investing in fixed income designed to be less sensitive to interest-rate changes

Just booked a long-anticipated vacation? Celebratory dance! Just enrolled in the maintenance plan for your HVAC system? That’s far less exciting. But when your AC quits in a heat wave, you’ll be dancing when the tech shows up for priority service. As investors, sometimes we need a reminder why we enroll in the less flashy stuff, too. While the stock market has soared in 2021, it’s been a tougher ride for fixed-income investors. Interest rates are exceptionally low to help support the economy, and even though rates were expected to go nowhere but up, they defied expectations and dipped even lower for much of the year. With yields (the expected return on a bond) so low and volatility potentially rising, it wouldn’t be surprising if you’ve wondered what bonds have done for you lately. But like signing up for just-in-case maintenance can keep you cool in a pinch, bonds can help us maintain our portfolios’ cool, too. Especially today, when there’s still the threat of volatility and uncertainty from shifting interest rates, it’s important to remember why we bother with bonds in the first place: diversification.*

Team Bonds vs. Team Stocks: It’s Not Really a Competition

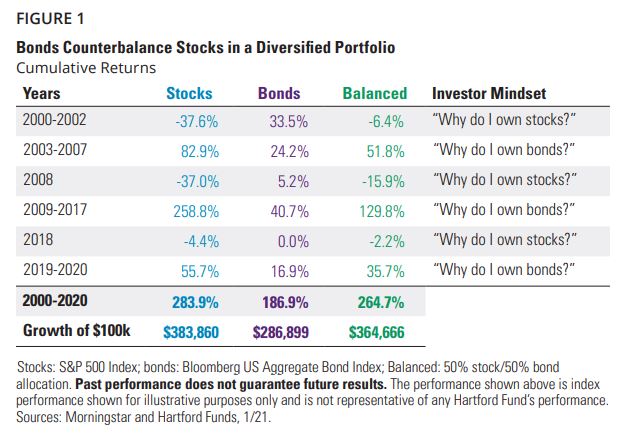

There’s a give and take to diversified, balanced portfolios. Sometimes, stocks soar and leave bonds in the dust (ahem, 2021). But other times, stocks are volatile and

bonds provide a welcome degree of stabilization. In other words, if you’re well diversified, one part of your portfolio is likely to

outperform as another underperforms at any given moment. Ultimately, this balance should provide a less volatile experience overall. All the portfolios in FIGURE 1 generated significant positive returns over the time period shown, but the balanced one provided a less turbulent journey.

Unfortunately, there’s no telling which asset class is going to be in favor in any given year. Even the experts who thought rising rates were a no-brainer this year have gotten it wrong lately. That’s why it’s important to work with your financial professional to be prepared for whatever the market throws at you. With continued interest-rate uncertainty on the horizon, here are three strategies to discuss with your financial professional that may better withstand shifting interest rates:

- Core-plus funds, which hold a foundation of investment-grade bonds but have the ability to augment that core with other, more opportunistic bonds;

- Bank loans, which have variable interest rates that adjust to the market; and

- Multi-sector approaches, which have the flexibility to adapt to changing environments.

Whatever you decide, working with professionals who have experience and extensive resources should make it a little easier to sit back and focus on other important things. You know, like putting your feet up in your perfectly climate-controlled home to plan a well-deserved vacation.

Talk to your financial professional about investing in actively managed fixed income that’s designed to be less sensitive to interest-rate changes.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. Bloomberg US Aggregate Bond Index is composed of securities from

the Bloomberg Barclays Government/Credit Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index.

“Bloomberg®” and any Bloomberg Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of

the indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Hartford Funds. Bloomberg is not affiliated with Hartford Funds, and Bloomberg does

not approve, endorse, review, or recommend any Hartford Funds product. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information

relating to Hartford Fund products.

Important Risks: Investing involves risk, including the possible loss of principal. • Fixed income security risks include credit,

liquidity, call, duration, event and interest-rate risk. As interest rates rise, bond prices generally fall. • Loans can be difficult to

value and less liquid than other types of debt instruments; they are also subject to nonpayment, collateral, bankruptcy, default,

extension, prepayment and insolvency risks.

CRN000000-1299090

Recent Comments