The Three Prongs of Inflation. From Hartford Funds

Supply-chain bottlenecks and disruptions are holding up inflation longer than expected;

here’s what investors need to know.

The US Federal Reserve (Fed)’s message on inflation has changed. Fed

Chairman Jerome Powell recently characterized supply-chain bottlenecks

and disruptions as “frustrating” and as “holding up inflation longer than we

had thought.” The Fed’s mea culpa is small consolation for investors whose

portfolios haven’t been positioned optimally for a longer-than-expected

period of higher inflation.

I previously said inflation would likely be stickier than the market or the

Fed anticipated. The question now is: Has inflation already peaked? In my

opinion, the short answer is no.

The Systemic Nature of Supply Shocks

Inflation is being pushed higher by three catalysts—labor, raw materials,

and transportation—that are interrelated in ways that create longer-lasting

systemic risks for the economy. I use the term systemic because of the

parallel to systemic financial risks, in which stress in one area of the market

spills over into other parts of the financial system, amplifying the initial

problem.

For example, the CEO of a computer hardware company recently told our

analysts that it wasn’t just semiconductors that were in short supply, but

also plastic, resin, copper, and steel. Then once the hardware is built, it’s

transported on container ships that are backed up at US ports. Finally, a

scarcity of truck drivers and port workers means that getting the finished

products to stores is delayed.

Thus, while some supply-chain strains may ease relatively soon, the ongoing

bottlenecks could take at least another year to resolve.

Why Supply-Chain Issues (and Inflation) Could Persist

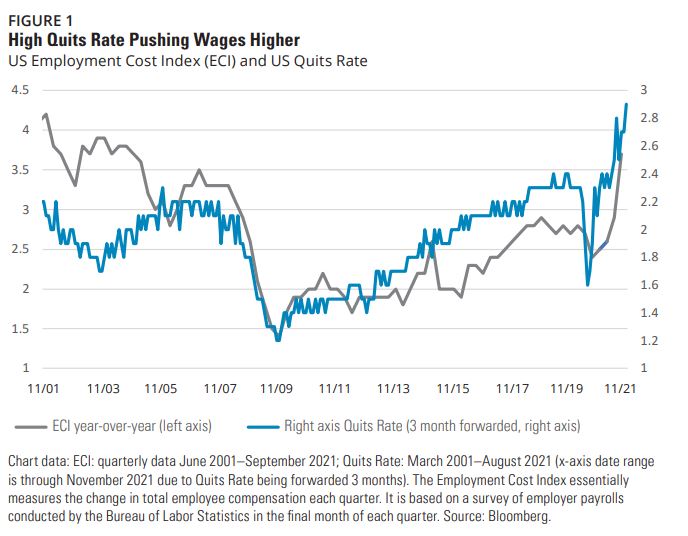

- Labor: US wages are up 4.6% over the past year (as of September 2021)

amid a tight labor market. Indeed, FIGURE 1 shows the highest job

quits rate in 20 years, suggesting workers are confident in their ability

to find other employment. This is a good predictor of potentially even

higher wages going forward. Meanwhile, some 5 million people have left

the labor force during COVID-19, half of whom are 65 and older. Lower

immigration rates and lingering health concerns have also shrunk the

labor pool. Finally, strikes at large corporations across industries reflect

a shift in power from management to labor, which could put more

upward pressure on wages. Elsewhere, COVID-19 resurgences in Asia

shut down factories and ports, exacerbating supply challenges.

- Raw materials: The price of oil is up a stunning 80% year-to-date. Other commodity

prices, such as metals, are up around 30%. Part of the story here is demand-driven as

the global economy reopens, but there are two other contributing factors that may be

longer-lasting. First, commodity supplies are constrained due to much lower capital

expenditures and greater capital discipline after a period of overinvestment and

underdelivering to shareholders. Second, decarbonization is raising the breakeven price

at which companies can increase production economically. The result: shortages of

everything from computers to cars, canned goods, and clothing.

- Transportation: The average price to ship a 40-foot container has quadrupled over the

past year.1 Bottlenecks at temporarily shut-down seaports and a flurry of congestion at

rail terminals, warehouses, and distribution networks are extending the time it takes

to move goods from China and other Asian ports to the US. It’s also been taking a long

time just to get empty containers to where they are needed. Shortfalls may be peaking

though, as some labor conditions ease and more transportation assets come online.

- Housing: Could housing become the fourth prong of higher inflation? US home prices

are up around 20% over the past year, while rents are up around 10% nationally. Owner’s

equivalent rent (OER),2 the Consumer Price Index (CPI)3 code for “shelter costs,” is driven

by the rental market and represents 30% of core CPI. I wouldn’t be surprised to see OER

rise 4%-6% by the end of 2022, which could tack 1.2-2.0 percentage points onto inflation

over the next 12 months

CRN000000-1311243

Recent Comments