Always the Season by Statera Asset Management

Each spring, we hear echoes of a favorite line among many market watchers: the months of May through October

have proved the worst of all in terms of return for U.S. investors, so better to watch out. Perhaps even cut and

run. Among other such compartmentalizations of historical returns, the goal presumably is to show that there

are ways to profitably time exposure to the market. Let it be known that we’ve yet to see such a review

consistent enough to warrant a drift from our long-term approach to investing.

– It’s true that the months of May through October seem to have been less favorable from a total return

standpoint over the years

– The return is still positive, however, just less so than during other months of the year

– The upshot is that remaining invested throughout the year still has proved a more fruitful strategy than

attempting to time market move

Sell in May and Go Away?

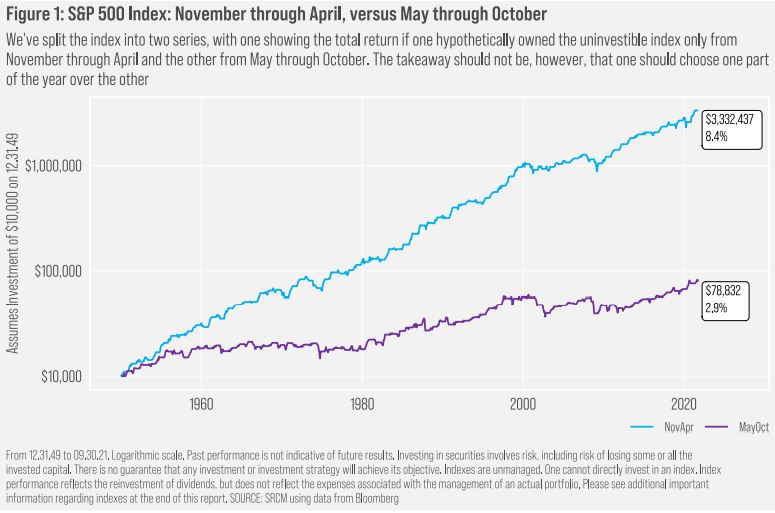

It’s a well-worn mantra in stock circles that the months between April and November might best be avoided. And

market history for a time suggested investors might have been better off had they taken heed. But since the close of

World War II, those following the refrain might have been disappointed. Sure, the cumulative long-term returns for

U.S. stocks (as proxied by the S&P 500 Index) from the months that include May through October remain the worst

of any consecutive six-month combination. And six of the ten-worst single-day declines in the S&P 500 have occurred

in those months. However, looked at another way, as we do in Figure 1, that returns from May through October are

on average worse than those during the other six months of the year is a fact without much consequence. Who cares

that the returns are lower? They’re still positive.

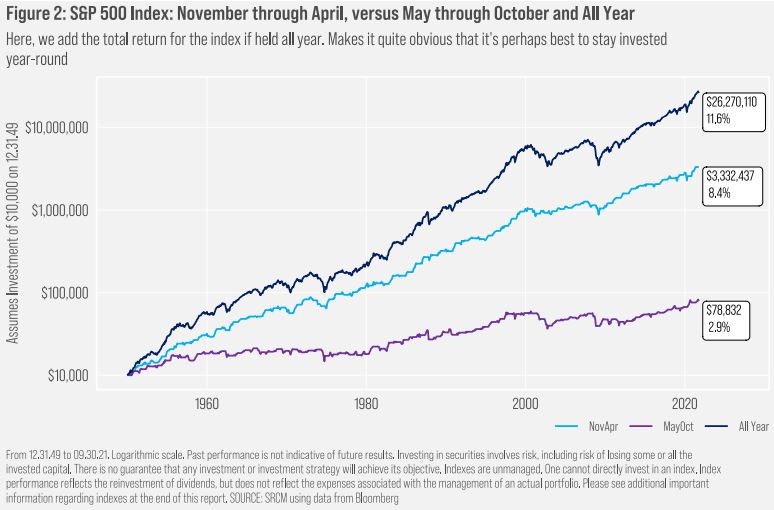

And that means that investors might have been better off by remaining invested throughout the year. And by better off,

we mean substantially so. Thanks to the “miracle of compounding,” even what seems like relatively meager additional

gains of 2.9% per year over the May-October period may have helped to build wealth over time. An investor who sat

tight might have generated a total return of 11.6% per year since the beginning of the 1950s, much better than the

8.4% return generated when one invested in only the “best” six-month period of the year.

Getting the Full Picture

This is another fine example of market legend that potentially leads investors to make poor choices regarding long-term

financial plans. The way the story often is offered, it may leave the impression that returns are negative, on average,

across the May-October period. And folks might react “accordingly”. As we’ve shown, though, returns are meaningfully

positive over those months, too.

Markets have become a good bit more volatile seemingly in light of concerns with regard to global inflation trends,

challenges within China’s real estate sector, politicking over the U.S. national debt, insecurities around energy

availability through the winter, and the stability of the Federal Reserve Board membership. Songs with rhymes like the

one that prompted this note likely will grow louder. But we caution readers that, unless individual financial

circumstances have changed greatly over the medium-term, it’s often been the better course to remain true to an

existing investment plan, rather than joining in with the time-the-market chorus.

Important Information

Statera Asset Management is a dba of Signature Resources Capital Management, LLC (SRCM), which is a Registered Investment Advisor. Registration of

an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational

purposes and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should

be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence

as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the

suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable

definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully

reviewed prior to making any investment decision. Please contact your investment adviser representative to obtain a copy of Form ADV Part 2. All data

presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research

and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources

believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss

arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations

associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent

all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified

or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future

events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus,

potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an

offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the

appropriate investment vehicle.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. equity market.

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate

taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS

(agency and non-agency).

One cannot invest directly in an index. Index performance does not reflect the expenses associated with the management of an actual portfolio.

Investing in any investment vehicle carries risk, including the possible loss of principal, and there can be no assurance that any investment strategy will

provide positive performance over a period of time. The asset classes and/or investment strategies described in this publication may not be suitable for

all investors. Investment decisions should be made based on the investor’s specific financial needs and objectives, goals, time horizon, tax liability and

risk tolerance.

CRN000000-1299090

Recent Comments