6 tips to navigate volatile markets: When markets get choppy, it pays to have an investing plan and to stick to it. by Fidelity Viewpoints

1. Keep perspective: Downturns are normal and typically short

• Market downturns may be unsettling, but history shows stocks have recovered and delivered long-term gains.

• Over the past 35 years, the stock market has fallen 14% on average from high to low each year, but still managed gains in 80% of calendar years.

Past performance is no guarantee of future results. See footnote 1 for details.

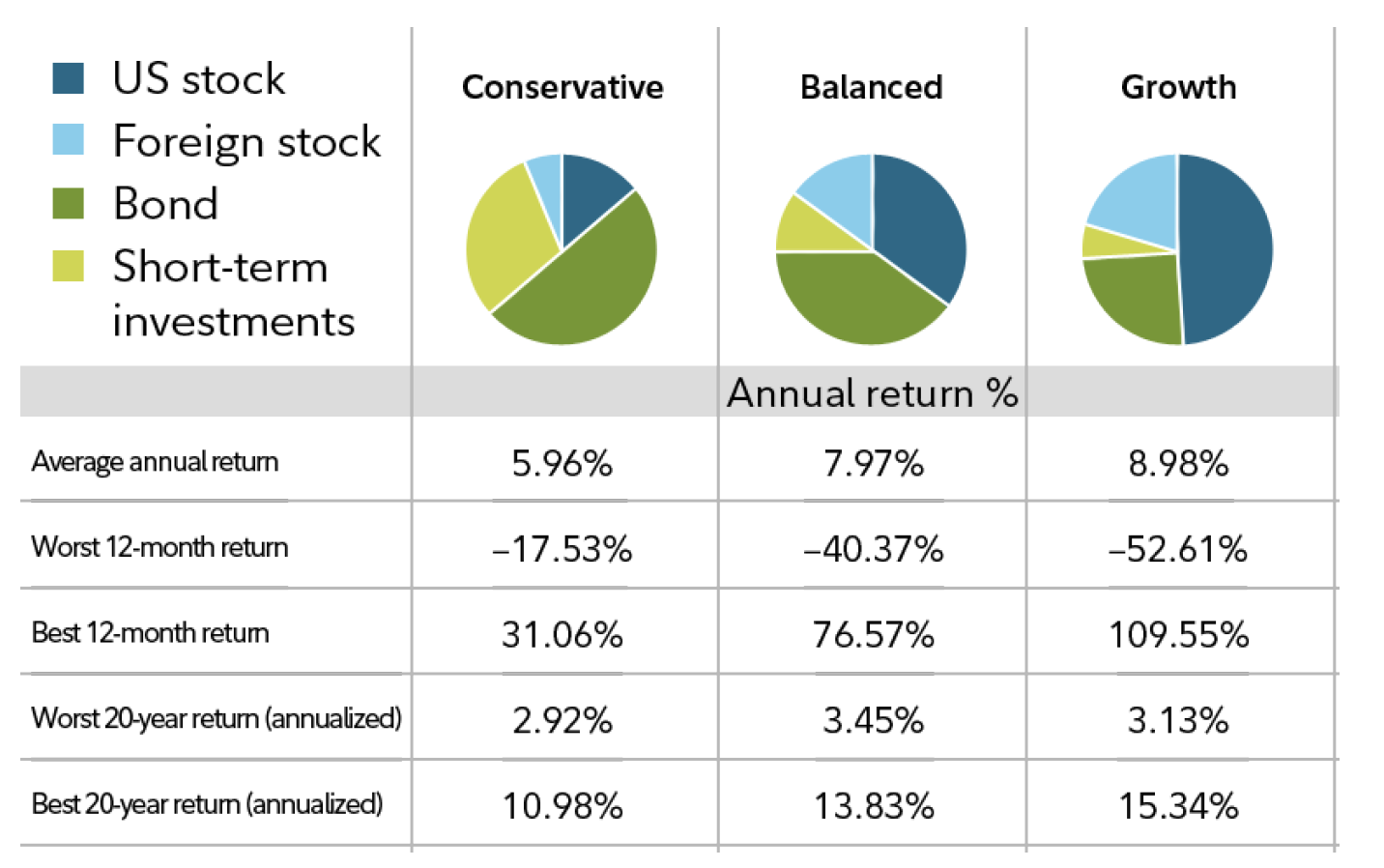

2. Get a plan you can live with – through market ups and downs

• Your mix of stocks, bonds and short-term investments will determine your potential returns, but

also the likely swings in your portfolio.

• Pick an investment mix that aligns with your goals, timeframe, and financial situation, and you can

stick with despite market volatility.

Past performance is no guarantee of future results. Data source: Morningstar, Inc., 2019 (1929-2018). See footnote 2 for details.

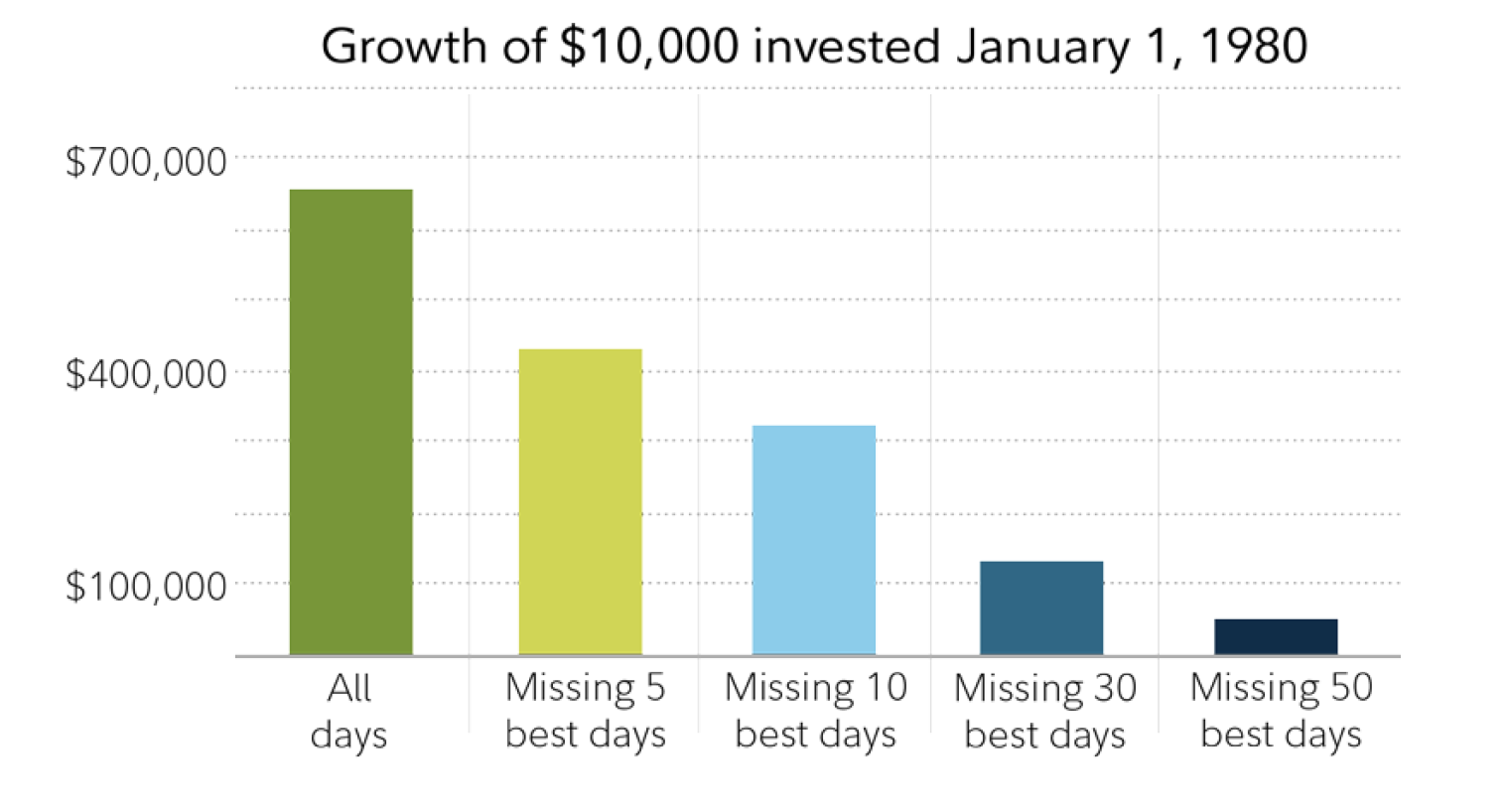

3. Focus on time in the market – not trying to time the market

• It can be tempting to try to sell out of stocks to avoid downturns, but it’s hard to time it right.

• If you sell and are still on the sidelines during a recovery, it can be difficult to catch up. Missing even

a few of the best days in the market can significantly undermine your performance.

Past performance is no guarantee of future results. Source: FMRCo, Asset Allocation Research Team, as of January 1, 2019. See

footnote 3 for details.

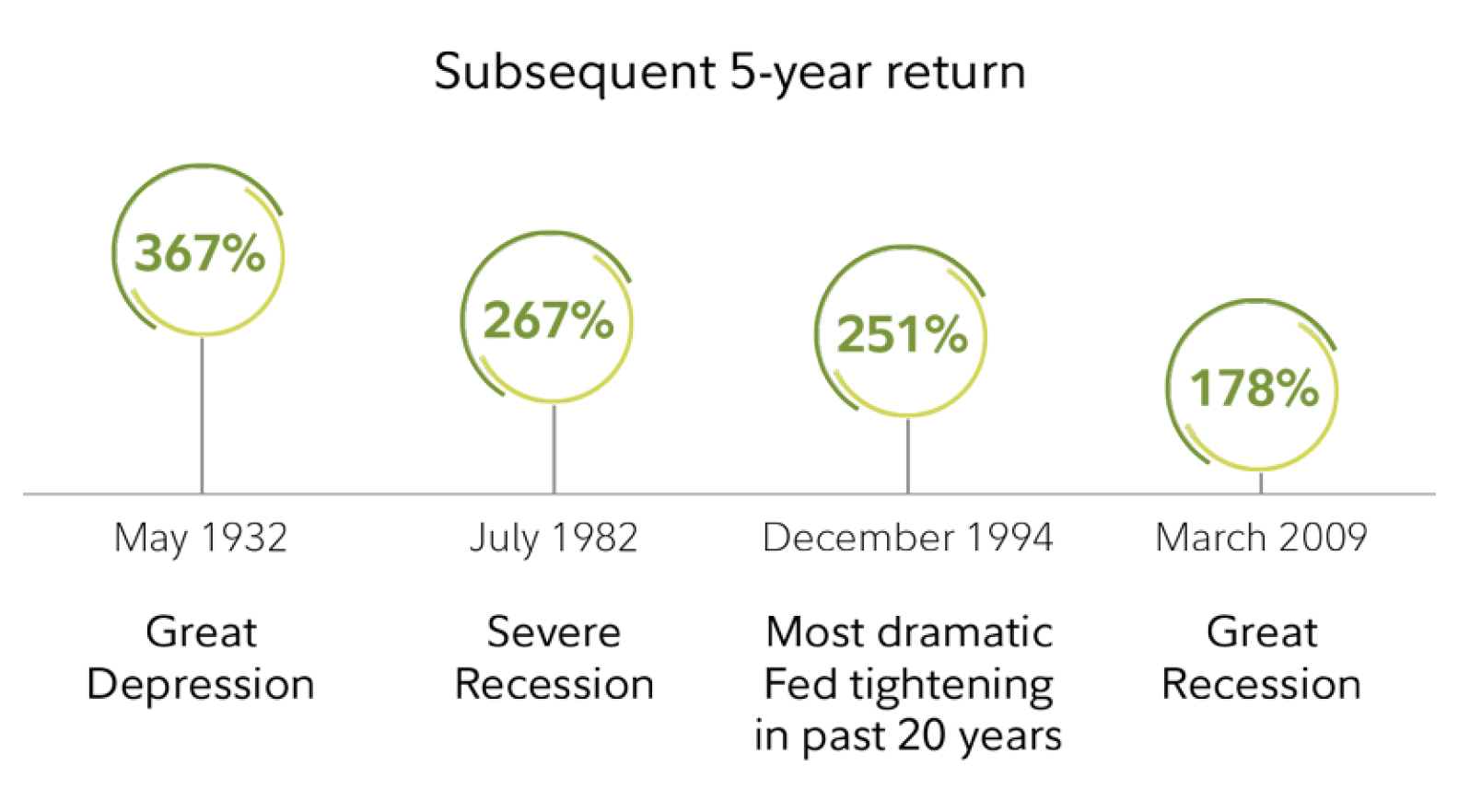

4. Invest consistently, even in bad times

• Some of the best times to buy stocks have been when things seemed the worst.

• Consistent investing can give you the discipline to buy stocks when they are at their cheapest.

• Consider setting a plan for automatic investments.

Past performance is no guarantee of future results. Sources: Ibbotson, Factset, FMRCo, Asset Allocation Research Team as of

January 1, 2019. See footnote 4 for details.

5. Get help to make the most of a down market

• While no one likes to lose money, your financial advisor may be able to help you take advantage of a

down market.

• Tax rules may let you use losses on some of your investments to reduce your future tax bills, or use

lower share prices to convert to a Roth IRA at a lower tax cost.

• Down markets may also be a good time to meet with your advisor to discuss adjusting your

investment mix, or taking advantage of opportunities when prices are low.

6. Consider a hands-off approach

• If you are not comfortable with market risk, consider turning your portfolio over to a professional

through a managed account or all-in-1 mutual fund.

• If you don’t have a strategy, or think yours may be off track, start planning now with our online

tools. Visit Fidelity’s Planning & Guidance Center today.

1. The S&P 500® Index is a market capitalization–weighted index of 500 common stocks chosen for market size, liquidity, and

industry group representation. S&P and S&P 500 are registered service marks of Standard & Poor’s Financial Services LLC. The

CBOE Dow Jones Volatility Index is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock

index option prices. You cannot invest directly in an index.

2. Returns include the reinvestment of dividends and other earnings. This chart is for illustrative purposes only and does not

represent actual or implied performance of any investment option. Stocks are represented by the Standard & Poor’s 500 Index

(S&P 500® Index). The S&P 500® Index is a market capitalization–weighted index of 500 common stocks chosen for market size,

liquidity, and industry group representation to represent US equity performance. Bonds are represented by the Bloomberg

Barclays US Intermediate Government Bond Index, which is an unmanaged index that includes the reinvestment of interest

income. Short-term instruments are represented by US Treasury bills, which are backed by the full faith and credit of the US

government. Indexes are unmanaged, and you cannot invest directly in an index. Foreign stocks are represented by the Morgan

Stanley Capital International Europe, Australasia, Far East Index for the period from 1970 to the last calendar year. Foreign

stocks prior to 1970 are represented by the S&P 500® Index. The purpose of the target asset mixes is to show how target asset

mixes may be created with different risk and return characteristics to help meet an investor’s goals. You should choose your

own investments based on your particular objectives and situation. Be sure to review your decisions periodically to make sure

they are still consistent with your goals.

3. The hypothetical example assumes an investment that tracks the returns of the S&P 500® Index and includes dividend

reinvestment but does not reflect the impact of taxes, which would lower these figures. There is volatility in the market, and a

sale at any point in time could result in a gain or loss. Your own investing experience will differ, including the possibility of loss.

You cannot invest directly in an index. The S&P 500® Index, a market capitalization–weighted index of common stocks, is a

registered trademark of The McGraw-Hill Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation.

4. US stock market returns represented by total return of S&P 500® Index. It is not possible to invest in an index. First 3 dates

determined by best 5-year market return subsequent to the month shown.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or

tax advice. Consult an attorney or tax professional regarding your specific situation.

Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or

economic developments. Investing in stock involves risks, including the loss of principal.

Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market, or economic

developments, all of which are magnified in emerging markets. These risks are particularly significant for investments that focus

on a single country or region.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

581885.33.3

Recent Comments