10 Things You Should Know About Sustainable Investing. From HartfordFunds

10 Things You Should Know About Sustainable Investing. By: Hartford Funds

Sustainable investing is becoming more mainstream. Here are some key things to consider.

Sustainable Investing

- Terminologies May Differ – There are many approaches under the sustainable-investing umbrella.

Examples include socially responsible investing (SRI); environmental, social, and governance (ESG)

integration; and impact investing. There isn’t currently a uniform definition of these terms and different

asset managers may define them differently. - Socially Responsible Investing (SRI) or Exclusionary Investing – The modern version of the term SRI has

its roots in the 1960s and aims to avoid what some consider to be socially “bad” companies (think tobacco

companies or casinos). - Environmental, Social, and Governance (ESG) – ESG criteria are a way to evaluate how a company behaves.

For example, environmental standards can measure how a company treats natural resources; social

standards can evaluate how a company manages relationships with its community; and governance criteria

can focus on issues such as recruiting women and minorities for the board - ESG in Action – The emphasis placed on ESG criteria varies across funds. Some funds may view ESG factors

as one consideration among many as they make their investment decisions. Other funds may demonstrate a

higher level of commitment to ESG investing by making it a key consideration in their investment decisions. - Impact Investing – This strategy generally involves seeking to generate positive, measurable, reportable

social and/or environmental impact alongside a financial return. For example, an “impact” fund may invest

in companies that strive to make the world a better place, such as renewable power-generation company, a

water-treatment facility, or a company that seeks to eradicate a disease. - Performance Matters – Sustainable funds ”comfortably outperformed their peers” in 2020.1 Further

diminishing lingering assumptions that sustainable investment strategies will underperform, 35% of

sustainable funds finished in the top quartile of their Morningstar Categories and 66% in the top half. - Not Just for Millennials – Contrary to popular opinion, many investors across all ages feel positively about

a sustainable portfolio: 44% of people age 71+ as well as 60% of people age 18-37 rated it favorably. - Explosive Growth – Sustainable investing is growing in popularity. During the last decade, it’s become

a mainstream strategy as opposed to an aspirational concept. In fact, $17.1 trillion was invested in

sustainable-investing strategies in the US at the beginning of 2020, up 42% from just two years prior. - Something to Talk About – A recent study found the top three issues for asset managers and their

institutional clients are climate change/carbon, sustainable natural resources/agriculture, and board

governance.3 Your list may be quite different. Talk to your financial professional about the causes you

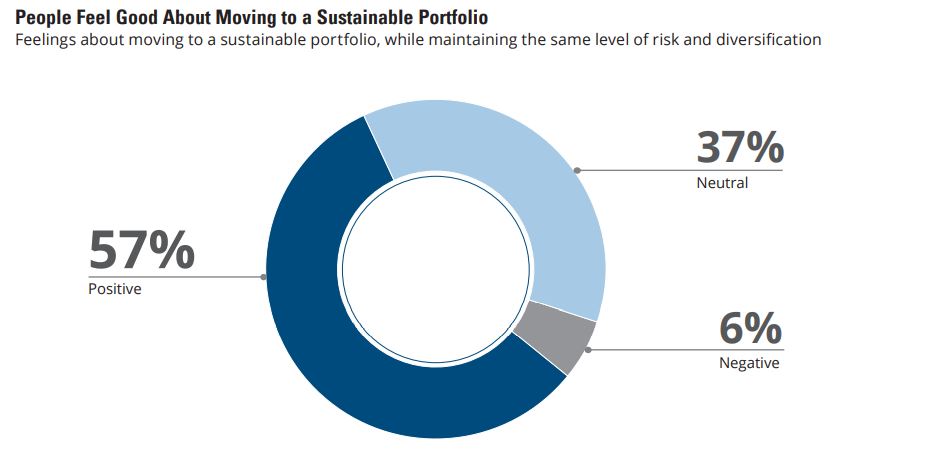

support or issues that concern you. - Changing Perceptions – Despite some lingering reservations about sustainable investing, 57% of people

say they would feel optimistic about incorporating sustainable funds into their portfolio. Many of

those who felt positively attribute this to the positive environmental impact pursued by some sustainable strategies.

CRN000000-1299090

Recent Comments